Why Investing in Women Led Businesses Strengthens the Entire Workforce

Women led businesses are essential for a healthy economy because they solve problems that have historically been misunderstood or ignored. When female founders receive only a small fraction of available investment, the result is more than a funding gap. It shapes innovation, women’s salaries, and whether women stay in the workforce. These connections influence economic growth, workplace equity, and the wellbeing of families and communities.

Women Founders Solve Problems That Would Not Otherwise Be Addressed

At Mind the Gap Services, we constantly meet with founders who are building solutions based on real lived experiences. When women describe why they created their products, their personal insights often highlight needs that have gone unrecognized. Many speak about autoimmune symptoms, maternal care, hormonal shifts, and daily systems designed without women in mind.

Some of these challenges are deeply familiar. Others reveal how long innovation has been delayed simply because women were not the ones shaping the solutions. Medical research illustrates this clearly. Before 1993, federally funded clinical trials rarely included women. As a result, decades of treatments and diagnostic tools were developed based on male physiology. We are still catching up, which is why outdated procedures like traditional mammograms remain common while innovators such as Dr. Ilan’s work at her company Feminai brings more advanced, non-compressive technology to the United States.

When women lead innovation, society benefits. To innovate at scale, they need capital.

Certain markets that serve women, such as, beauty, wellness, grooming, fertility, menstrual health, and broader women’s health are among the most resilient and lucrative consumer sectors globally. Despite this strong market demand and predictable customer behavior, venture capital disproportionately flows to male founders even in these categories. Male founders frequently receive large checks while female founders with stronger traction and clearer product-market fit struggle to raise equivalent capital. This is incomprehensible and according Forbes article, Even When Markets Serve Women, Male Founders Still Get The Money — And VC Keeps Paying The Price, a more appalling fact, “Male founders in femtech continue to raise disproportionately more than women — even when the product, the users, the biology, and the market dynamics require expertise women founders are more likely to possess.”

How the Funding Gap Affects Women’s Pay and Career Growth

Underfunding women led companies affects far more than the founders. When these businesses struggle to access capital, they also struggle to hire, promote, and retain women at competitive salaries. This influences whether women can remain in their jobs once the realities of childcare, elder care, and household responsibilities come into play.

Melissa French Gates recently noted in Fortune that the number of women in the workforce decreased by 500,000 while the number of men increased by nearly 400,000. This shift points to structural challenges rather than personal choices. Ms.Gates responded by creating a $60M grant contest called, Women Innovation Now (WIN), to figure out solutions that help women thrive and strengthen workplaces for all.

When funding is limited, the impact on women’s financial stability can be summarized clearly:

• Slower salary growth for women in underfunded companies

• Fewer opportunities for leadership and advancement

• Limited flexibility for caregiving needs

• A higher likelihood of women stepping out of the workforce because the cost of working exceeds the income earned

These patterns create long term consequences for families and for the economy.

Why Women Step Out of the Workforce

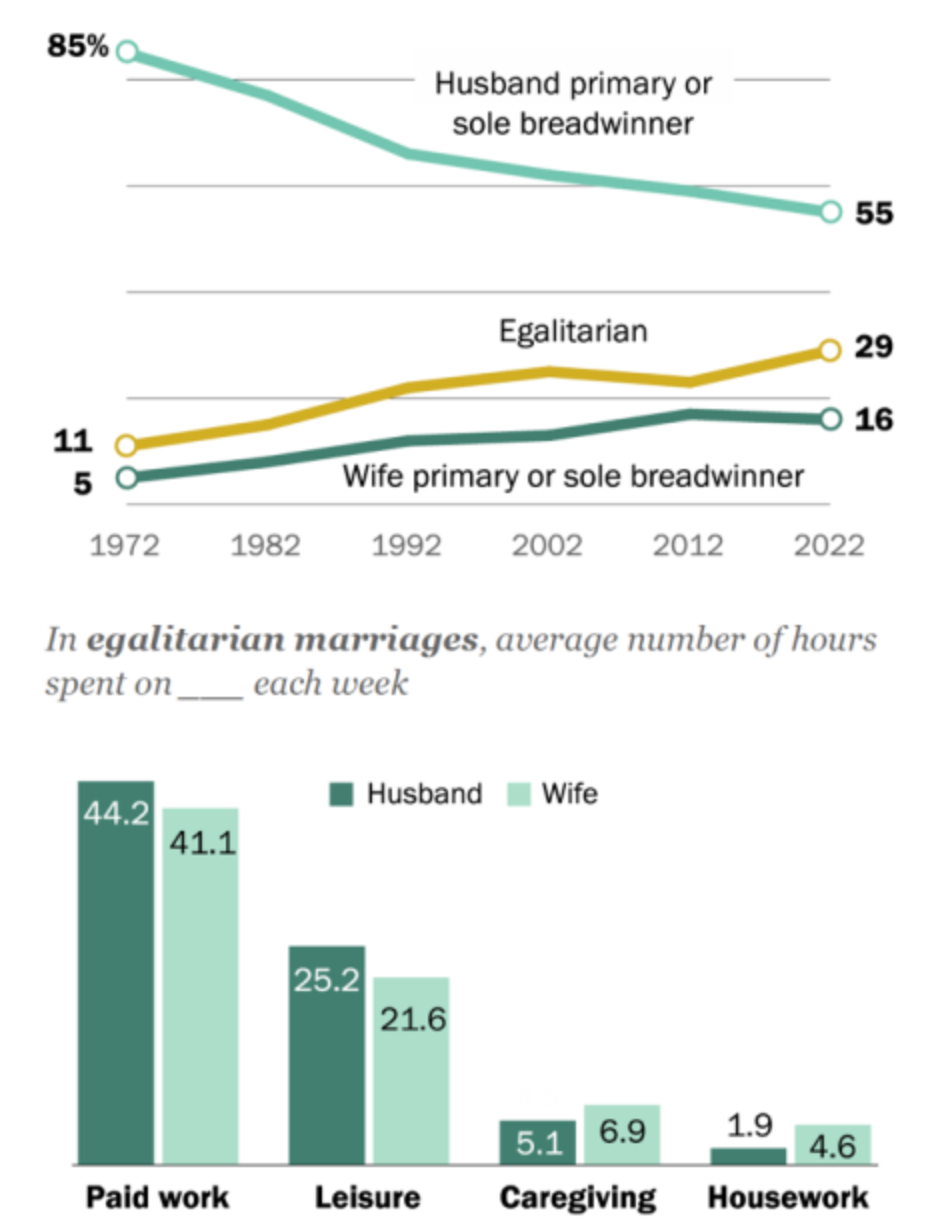

Women often carry a disproportionate share of household responsibilities. When job structures do not account for this reality, women face difficult crossroads. Lower pay makes the decision even harder. Many ask themselves whether it makes financial sense to continue working if childcare, school schedules, or elder care duties cannot be managed within the constraints of a traditional workday.

Source Pew Research Center, NPR article

These decisions are not hypothetical. They come from conversations I have had with highly skilled women. One example is a PhD researcher in infectious disease who left her career because childcare for three children cost more than her salary. Another is a senior PR leader who could not travel due to conflicting family schedules. Her employer did not offer flexibility, her opportunities decreased, and she ultimately stepped away.

These outcomes are not about ambition or capability. They are about conditions that do not support women’s full participation.

The Broader Result of Underfunding Women Led Innovation

When women do not receive the investment needed to build companies, the effects reach across society. Innovation slows in fields that predominantly affect women. The gender pay gap widens. Leadership pipelines shrink. Economic mobility becomes harder for women at all stages of their careers. Workplaces continue to be built around outdated expectations that no longer reflect modern households.

When women do receive funding, the opposite occurs. Women led companies are more likely to hire and promote women, design supportive work structures, and build products that address the needs of caregivers and families. Companies such as Hatch, Minted, Eventbrite, and HopSkipDrive demonstrate what becomes possible when women secure capital.

The Case for Increasing Investment in Women Led Startups

Investing in women led companies is not a niche interest. It is a growth strategy for the entire economy. Women founders bring different perspectives to product design, workplace culture, and problem solving. Their companies tend to support broader quality of life outcomes and contribute to a more stable and diverse workforce.

If we want women to stay in the workforce, rise to leadership roles, and drive meaningful innovation, investment must increase. Women have the ideas, the insight, and the determination. What they need is equitable access to the capital that fuels opportunity.

Supporting women led businesses is not simply the right thing to do. It is a decision that strengthens families, companies, and the economy as a whole.